Emergency Funds: One Size Does Not Fit All

The standard advice for emergency funds often suggests saving 6 months of living expenses in cash. That is a helpful starting point. For many Veterans, it may not be the right number.

If you receive military retirement pay or VA disability compensation, you already have a stable source of income that is not affected by the stock market or job changes. That steady cash flow changes how much you truly need in reserve. Instead of basing your emergency fund on your total expenses, consider focusing on the gap between your guaranteed income and your necessary monthly costs. This includes essentials like housing, food, utilities, and insurance. If your benefits already cover most of those, you may not need to hold as much cash on the sidelines.

There is also the opportunity cost to consider. Keeping too much in cash can feel safe, but it can also limit your long-term growth. Money that sits still for years is money that is not working toward your financial goals.

How Holding Too Much Cash Can Hurt Over Time

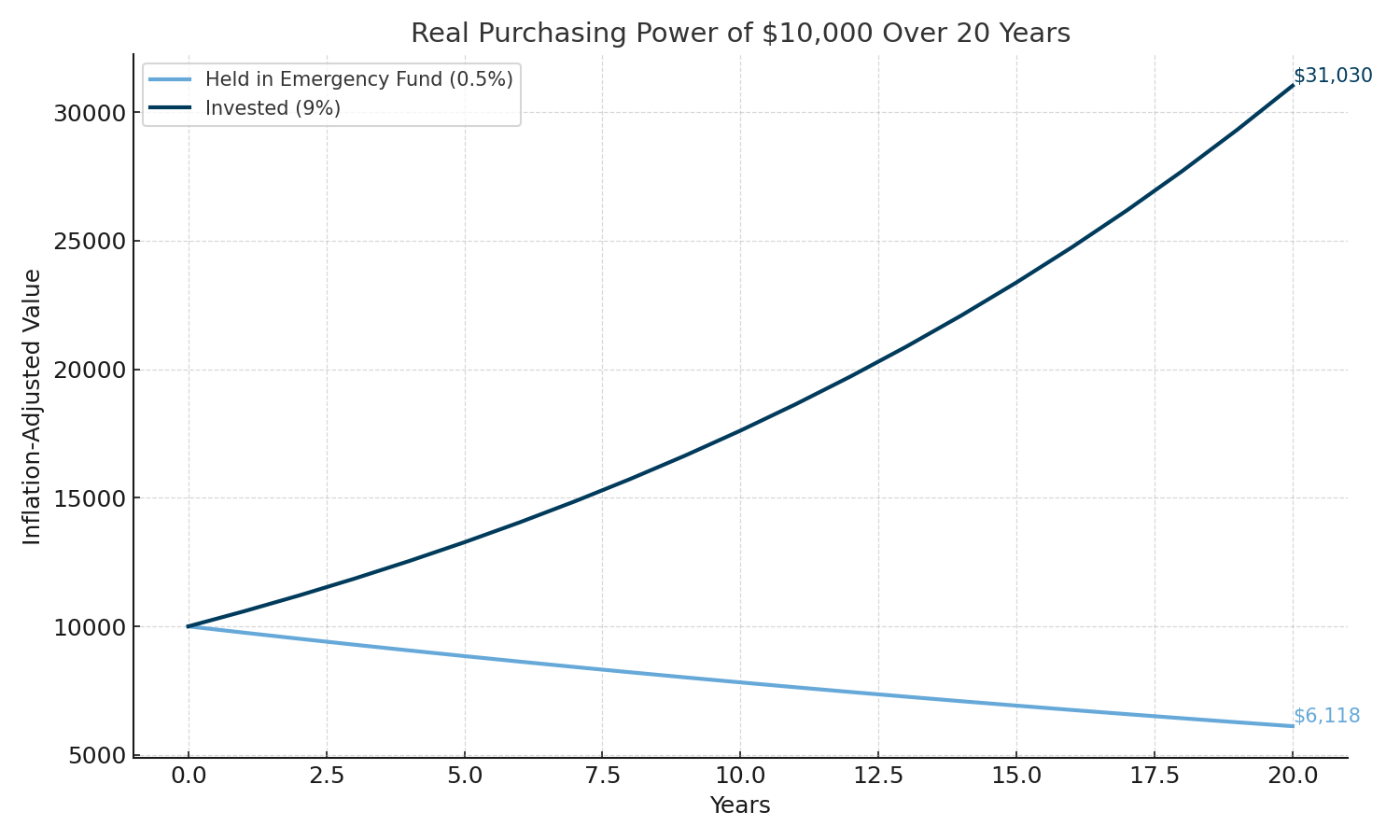

While Emergency Funds are important, holding too much cash for too long can quietly work against your financial goals. That is because cash typically earns less than inflation, meaning your purchasing power shrinks over time. Let’s say you keep an extra $10,000 in a savings account earning 0.5 percent per year. Now imagine you had instead invested that money with a long-term return of 9 percent, while inflation averaged 3 percent.

The chart below compares the purchasing power of that $10,000 over 20 years, after adjusting for inflation:

Even after inflation, the invested money purchasing power grows significantly, while the low-yield emergency fund does not keep up. This does not mean you should invest every dollar. It simply shows that the opportunity cost of holding excess cash is real and over time, it adds up.

Emergency savings still need to help you sleep at night. The key is finding the right balance between peace of mind and long-term growth. For Veterans with steady income from military retirement and VA benefits, the traditional rules around emergency funds may not apply the same way. A right-sized emergency fund should reflect your actual needs, not a generic rule. If you are unsure how much you should be holding in reserve or whether that money could be doing more for you, let’s connect.